Some car insurance providers understand this and accept it. As such, they want to overlook the very first accident a motorist has and won't increase your premiums. The information of a mishap forgiveness clause differ from service provider to provider to company. Some will immediately use mishap forgiveness, while others need that the insured has no mishaps for a period of 3 or 5 years prior to enabling this clause to enter into effect.

Take a Driving Course Taking a driving course could reduce your premiums after a mishap or a ticket. Your insurance provider may view it as you are taking an interest in improving your driving abilities. If they do, they might want to decrease your rate when it comes time to restore your policy.

Little Known Questions About 7 Ways To Lower Your Auto Insurance Rates - Ama.

This is an excellent way how to reduce car insurance coverage after a mishap or ticket. Nix Crash Protection Among the most efficient methods to minimize your car insurance premiums after a ticket or an accident - or any other time - is by getting rid of your crash protection.

Prior to you choose on this choice, make sure you identify if you are able to shell out more cash in the occasion that you do get into an accident in the future. Ask About Discount rates Most automobile insurance companies provide discounts to their policy holders.

What Can Raise Or Lower The Cost Of Your Car Insurance - Aaa Things To Know Before You Get This

That's not necessarily the case. Do some research study to learn if there is another service provider who wants to provide you a lower premium, despite your accident or ticket. Bear in mind that car insurer aspire to bring in new clients, and one method they can do that is by offering the best rate possible.

Listed below are other things you can do to lower your insurance coverage expenses. 1. Look around Costs vary from company to company, so it pays to shop around. Get at least 3 price quotes. You can call business directly or access details on the Internet. Your state insurance department might likewise supply contrasts of rates charged by major insurers.

The 20-Second Trick For Avoid Higher Insurance Rates After A Traffic Ticket - Myimprov

It's important to select a company that is economically steady. Get quotes from various types of insurance business. These agencies have the same name as the insurance business.

Do not go shopping by price alone. Contact your state insurance department to discover out whether they provide information on customer complaints by company. Select a representative or company representative that takes the time to address your concerns.

Fascination About Safe Driver Insurance Plan (Sdip) And Your Auto ... - Mass.gov

Prior to you purchase a cars and truck, compare insurance coverage costs Before you purchase a brand-new or used car, inspect into insurance coverage expenses. Cars and truck insurance premiums are based in part on the cars and truck's rate, the cost to repair it, its general safety record and the likelihood of theft.

Evaluation your coverage at renewal time to ensure your insurance requirements haven't changed. 5. Buy your property owners and automobile protection from the exact same insurer Many insurance companies will give you a break if you buy 2 or more types of insurance. You may likewise get a reduction if you have more than one automobile guaranteed with the exact same business.

Not known Facts About What Changes Should I Expect With My Car Insurance Rates ...

Ask about group insurance Some business offer reductions to drivers who get insurance through a group plan from their employers, through professional, organization and alumni groups or from other associations. Ask your employer and inquire with groups or clubs you belong to to see if this is possible.

Seek out other discount rates Companies provide discount rates to policyholders who have not had any mishaps or moving infractions for a number of years. You may likewise get a discount if you take a defensive driving course. If there is a young chauffeur on the policy who is a good student, has actually taken a motorists education course or is away at college without a car, you might also receive a lower rate.

11 Factors That Affect Car Insurance Rates - Money Crashers for Beginners

The essential to cost savings is not the discounts, but the final rate. A business that offers couple of discounts might still have a lower general rate. Federal Citizen Details Center National Consumers League Cooperative State Research Study, Education, and Extension Service, USDA.

Whether it's speeding or something else, getting a ticket is a humbling experience. Not only are you stuck to an unexpected expense you have to pay, but then you get struck in another area - your auto insurance increase. Today we're going to look at how to reduce your car insurance coverage after a ticket.

Not known Details About Car Insurance With Speeding Tickets Or Dui (With Rates) - The ...

Why do my cars and truck insurance rates go up since of a ticket? You can get a ticket for a variety of reasons.

you understand. To an insurance provider, if you have a ticket, it means a greater possibility of getting in a mishap one day. This is why your current insurance company keeps an eye on your driving record. And a higher opportunity of a mishap equals a greater danger for the insurance provider.

The Definitive Guide for 10 Confessions Of A Progressive Insurance Rep - Consumer ...

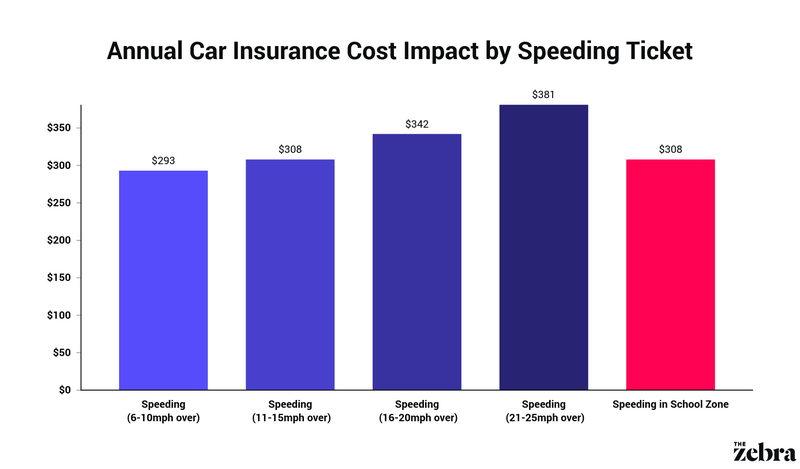

And that is available in the type of increased premiums. You may likewise be wondering just how much of a boost to your premiums we're talking about here. Let's put it this way - it's not quite. According to The Zebra, auto insurance rates can increase as much as 82 percent. It depends upon the kind of offense you're ticketed for.

This makes it a lot more essential to make sure you're getting as low of a rate as possible going forward. The very best techniques to decrease your automobile insurance Alright, let's enter into why you're here. Here are strategies you can use right now to control the increased cars and truck insurance expenses after a ticket.

The Definitive Guide to Speeding Tickets And Insurance Rates - Law Office Of Jeremy ...

Search When it concerns auto insurance coverage, it pays to search. The differences in between premiums from one auto insurer to the next can be substantial. There are several methods you can get head-to-head comparisons from different insurance coverage providers. You can: and put in your information for a car insurance quote.

such as Gabi or , that can compare several companies simultaneously for you. We'll go over Gabi in greater information later on, however Gabi can conserve you a lots of time by comparing a minimum of 40 different auto insurance carriers for you. Yes, looking for quotes will take a little bit of time, but this can make one of the largest impacts on the amount you pay, even after a ticket.